Tax Info

Available Forms

State:

MA Form 1 and MA Form 1-NR/PY are available in the library and by using the links below.

Other state forms are available online and are printable upon request.

Federal:

1040, 1040 SR, and 1040 SP forms and instruction booklets are available in the library. These forms are also available using the links below.

The IRS will be providing the library with a limited quantity of forms and instructions. We will update this page when the materials have been received. We do not know when we will receive a particular form, so please call ahead if you are looking for something specific.

Most Used Forms

Extension Forms

All Tax Year 2023 MA Tax Forms

Schedule 1 - USE IF YOU: Have additional income, such as unemployment compensation, prize or award money, gambling winnings. Have any deductions to claim, such as student loan interest deduction, self-employment tax, educator expenses.

Schedule 2 - USE IF YOU: Owe other taxes, such as self-employment tax, household employment taxes, additional tax on IRAs or other qualified retirement plans and tax-favored accounts, AMT, or need to make an excess advance premium tax credit repayment.

Schedule 3 - USE IF YOU: Can claim any credit that you didn't claim on Form 1040 or 1040-SR, such as the foreign tax credit, education credits, general business credit. Have other payments, such as an amount paid with a request for an extension to file or excess social security tax withheld.

Schedule A – Itemized Deductions

Schedule B – Interest and Ordinary Dividends

Schedule C – Profit or Loss from Business

Schedule C-EZ – Net Profit for Business - NO LONGER USED. USE SCHEDULE C INSTEAD, SEE IRS.GOV FOR MORE INFO.

Schedule D – Capital Gains and Losses

Form 8949 (complete if you are using Schedule D) - Sales and Other Dispositions of Capital Assets

Schedule E - Supplemental Income and Loss

Schedule EIC - Earned Income Credit

Form 2441 - Child and Dependent Care Expenses

Form 8812 - Additional Child Tax Credit

Schedule R - Credit for the Elderly or the Disabled

Schedule SE - Self Employment Tax

1040 ES - Estimated Tax for Individuals, Tax Year 2023

1040-V - Payment Voucher, 2022 available soon

Other Useful Info.

- Federal forms and publications are available online at: irs.gov/forms. You may order forms to be delivered by U.S. mail at: irs.gov/orderforms, or by calling 1-800-829-3676.

- 1099s and other employer forms may be ordered online: http://www.irs.gov/Businesses/Online-Ordering-for-Information-Returns-and-Employer-Return.

- Mass. Form 1-Resident and Form 1-Non-Resident booklets and additional Massachusetts forms and instructions are available online at: mass.gov/dor/forms or by calling the Department of Revenue at 1-800-392-6089.

- Filing 2021 tax returns: Information about 2021 Coronavirus Tax Relief and Economic Impact Payments is available online.

- Filing 2020 or 2021 tax returns: Recovery Rebate Credit Worksheets for those who did not receive stimulus checks they should have received can find the worksheet on page 59 of the 1040 Instructions booklet; the instructions for the worksheet appear on page 57. More information about the rebate is available here

Filing Assistance

- AARP Tax Aid will hopefully be available to senior taxpayers at the Norwood Senior Center. An appointment is required. Please contact the Norwood Senior center directly at (781) 762-1201 for more information.

- Other AARP Tax Aide sites: AARP Foundation Tax Aide Locator (available late January/early February to April 15)

- IRS Volunteer Income Tax Assistance (VITA) and the Tax Counseling for the Elderly (TCE) programs Under another federal grant program, IRS-certified VITA volunteers provide tax-preparation services to people who generally have income of $56,000 or less, as well as those with disabilities or limited English language skills. Call 800-906-9887 to find a nearby VITA site. Online assistance is also available.

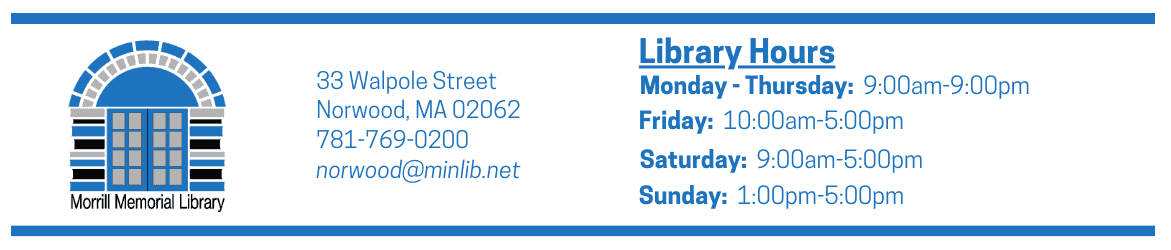

Library Hours:

- Monday – Thursday: 9:00am – 9:00pm

- Friday: 10:00am – 5:00pm

- Saturday: 9:00am - 5:00pm

- Sunday: 1:00pm -5:00pm